Understanding Bankruptcy Trustee Questions: A Guide

Prepare for your creditors’ meeting by understanding Bankruptcy Trustee Questions, their role in the process, and common queries about your petition.

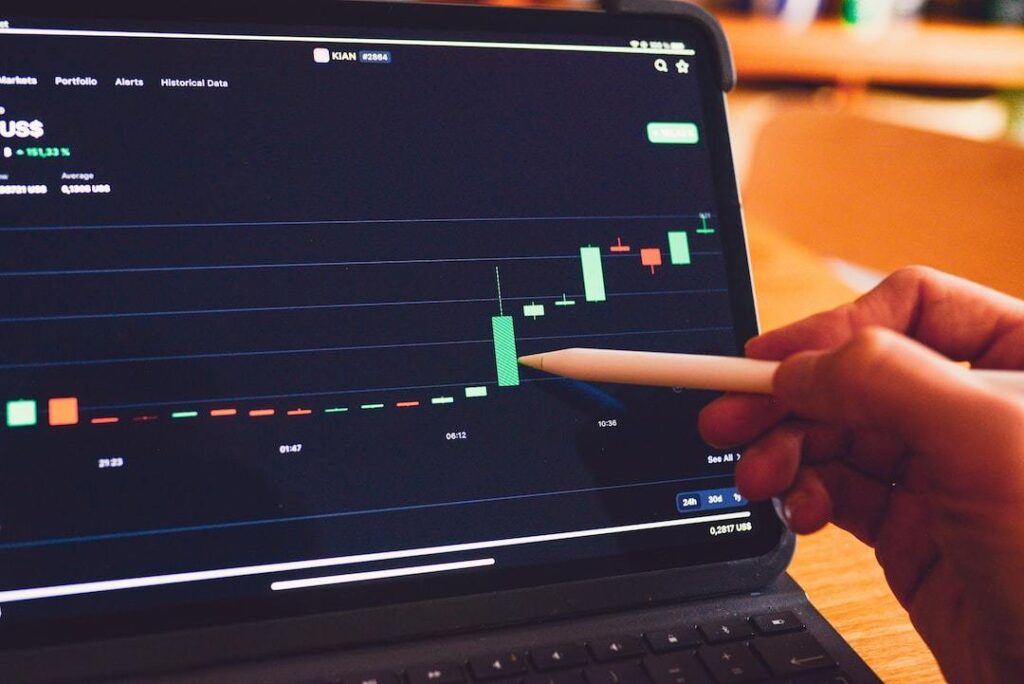

Rising Bankruptcy Filings in 2023: Understanding the Surge

Discover factors behind rising bankruptcy filings, tightened credit access, and Chapter 7 & 13 implications for consumers.

Navigating New York Bankruptcy Exemptions: A Guide

Explore our comprehensive guide on New York Bankruptcy Exemptions, including homestead, vehicle, and personal property exemptions to protect your assets.

Wedding Ring Exemption in Bankruptcy: NY Guide

Discover the essential guide to wedding ring exemption in bankruptcy in NY, protecting your precious jewelry during Chapter 7 and 13 filings.

Can I Still File Bankruptcy if I Don’t Own Anything?

Whenever you file bankruptcy in Westchester NY, you are required to list all of your assets. Your assets might include your house, the items in your house, your vehicles, your financial assets and other tangible items. Some assets are obvious, while others can be easily forgotten. Even if you don’t own a house, you might […]

Curious to know what happens during a bankruptcy consultation?

Curious to know what happens during a bankruptcy consultation? It’s great that you are taking the time to do research in advance, as this ensures you get the most from your consultation. This initial meeting is typically between 30 and 60 minutes long, and you will have the opportunity to speak with a bankruptcy attorney […]

How to tell if someone filed for bankruptcy

Explore our guide on Bankruptcy Filings Search, covering public records, credit reports, and alternative lending options for financial security.

Understanding the Role of a Chapter 7 Trustee in New York

Discover what is the role of a chapter 7 trustee in New York, from locating nonexempt assets to representing creditors’ interests and more.

Can I Keep My Car if I File Chapter 7 Bankruptcy? Explained

Can I keep my car if I file Chapter 7 Bankruptcy?” Discover car exemptions, leased vs financed cars, and wildcard exemption in our helpful guide.

Bankruptcy Wildcard Exemption: Tips to Maximize Protection

Discover how to maximize your bankruptcy wildcard exemption with our expert tips, ensuring the best protection for your assets during financial hardship.